Spartan Research Collective #03

Highlights

Welcome to the third edition of the Spartan Research Collective. Building upon our previous issues, we remain dedicated to exploring the Synthetix ecosystem and the expansive Optimism network, offering fresh insights and updates.

In this week's edition, we dive into the most recent performance metrics of Synthetix Perps, investigate tools for tracking on-chain trading activities, propose strategic recommendations for the growth of Synthetix, and provide the latest updates from the protocol. Join us as we continue to unravel the complexities of Synthetix and its pivotal role in the Optimism ecosystem.

Performance Overview

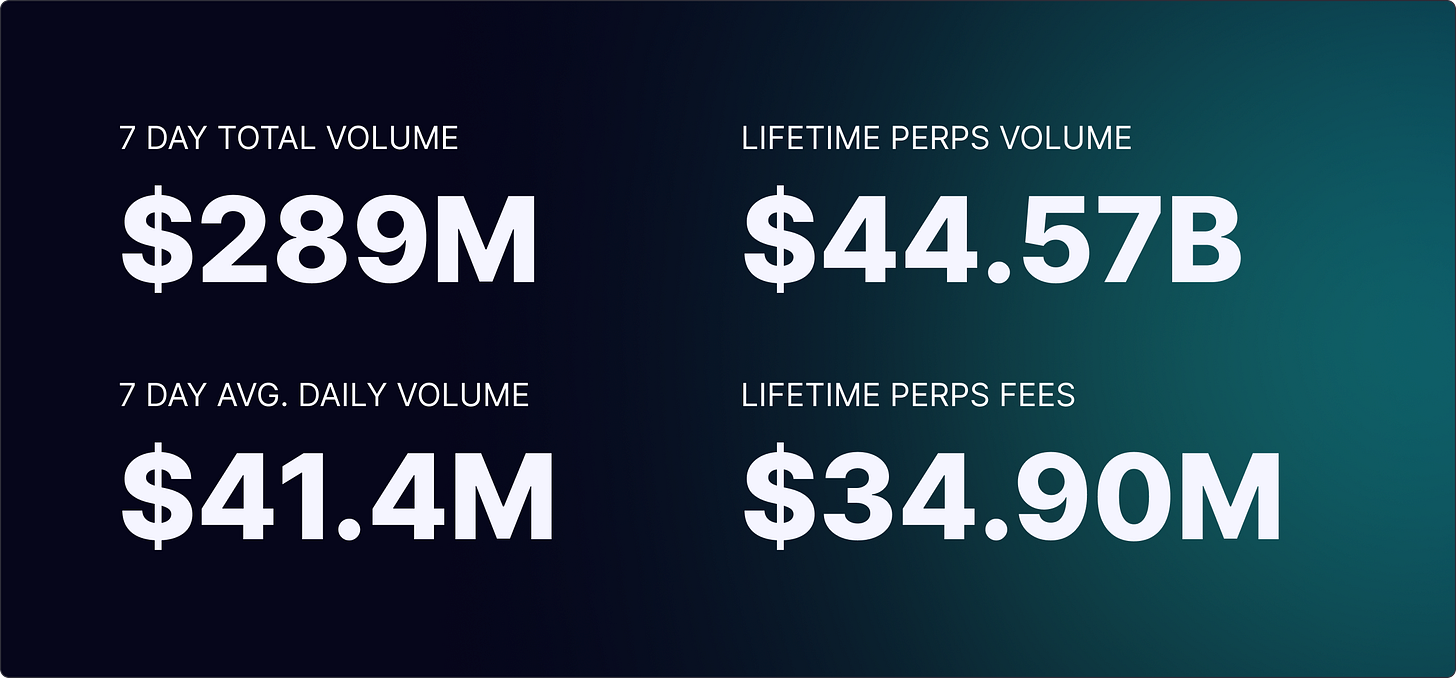

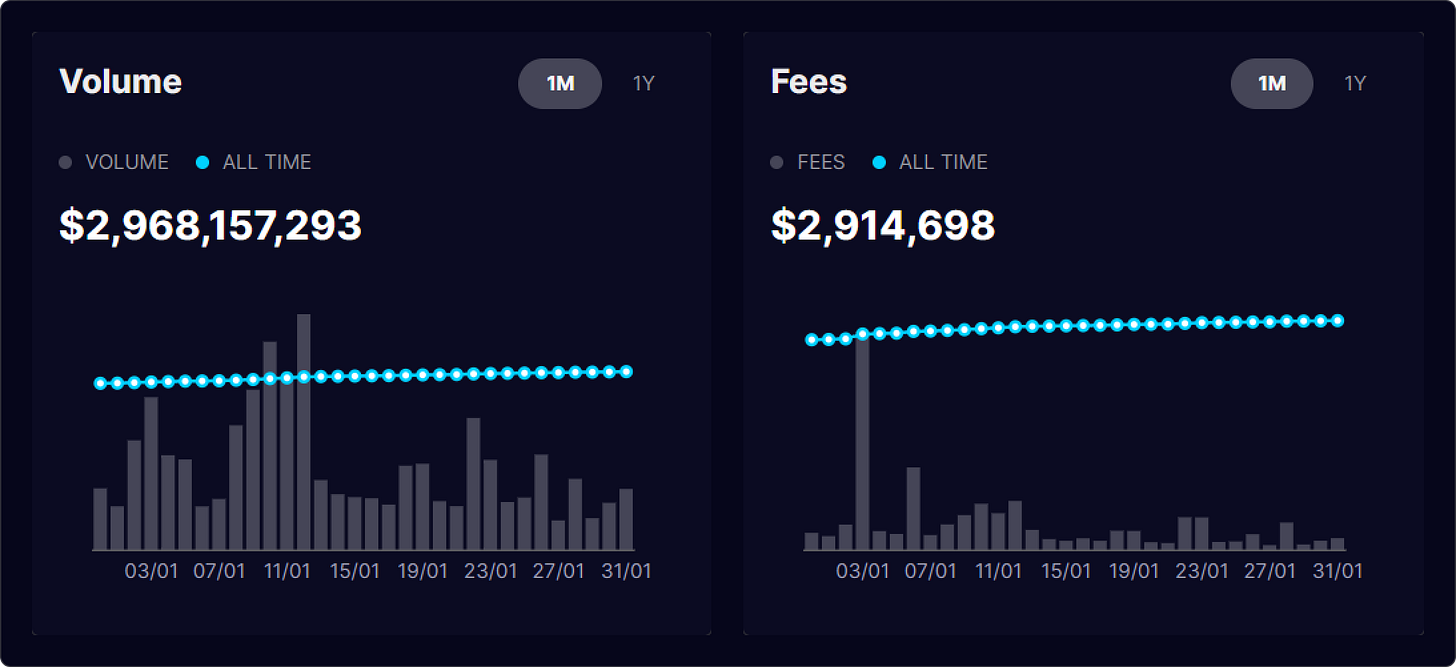

📊 Synthetix Perps Data Report:

- 7-Day Total Volume: $289 million

- Average Daily Volume: $41.4 million

- Lifetime Perps Volume: $44.57 billion

- Lifetime Fees: $34.90 million

On-Chain Analysis - Follow The Whales

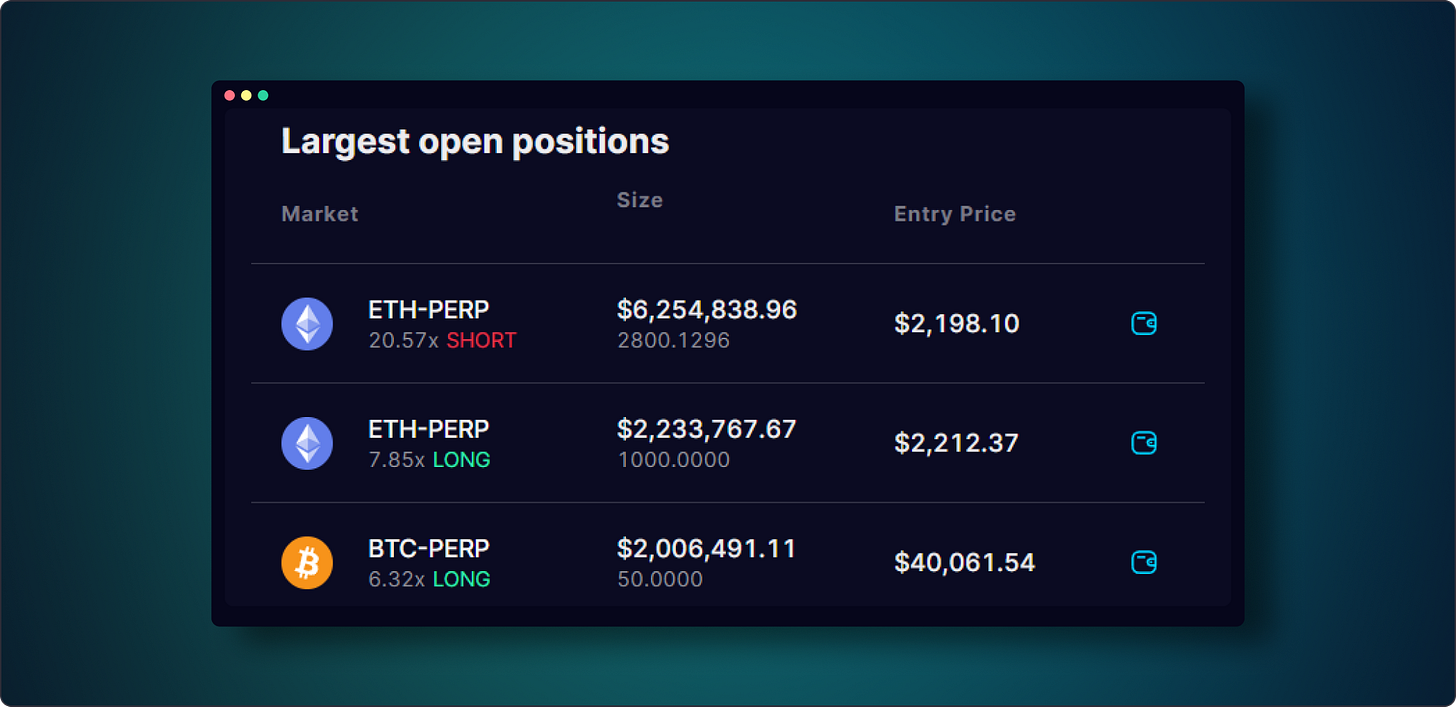

For those of you new to Onchain Trading, amidst the recent market volatility, you have the opportunity to follow your favorite wallets and observe how they navigate these volatile markets. A great tool to assist in this is the Synthetix Perps “Watcher” website. This platform is incredibly useful for traders embarking on their journey, offering real-time insights into trading strategies and market movements. Check it out at https://watcher.synthetix.io/positions to enhance your trading experience in these volatile times.

Currently the largest positions open are as follows:

The market has been really volatile lately, especially for Ethereum (ETH). In the past month, ETH's price has been ranging between $2,200 and $2,700.

Scaling Andromeda

In recent updates from Synthetix, the Andromeda Release has emerged as a key milestone. This release integrates Core V3 and Perps V3 on the Base chain, marking a significant step in Synthetix's evolution. Andromeda is already live, bringing in traders, developers, and integrators with initial caps on open interest and liquidity providers. These caps will gradually increase, transitioning users from Perps V2 to the more advanced Perps V3.

The Spartan Council, governing Synthetix, is closely overseeing this transition. They've outlined stages for ramping up, starting with initial liquidity seeding and moving towards expanding trading pairs and increasing caps. A notable update in Perps V3.1 is the introduction of asymmetric funding to balance liquidity provision.

Key features of Andromeda include multi-collateral support, enhanced liquidation processes, and a unique testing environment. It's a big leap for liquidity providers too, with USDC now an option for collateral, offering more efficiency. Traders can look forward to an improved experience with cross-margin and multi-collateral options.

The Basics of Staking SNX in 2024

Staking SNX tokens is key to fueling liquidity in Synthetix's derivative markets, including Perps, spot, and options trading. As a staker or liquidity provider, you play a vital role in ensuring these markets run efficiently, offering deep liquidity and low fees. In return, you receive a share of the trading fees as a weekly reward, helping to offset your debt.

Over the last year, Synthetix Perps has processed a massive $40 billion in trades, yielding over $30 million in fees for stakers. But remember, staking isn't risk-free. Market imbalances might require you to cover trader profits, posing a potential risk.

Here's a quick guide to SNX staking, specifically for the V2x system:

Stake SNX & Mint sUSD: Go to staking.synthetix.io, connect to either Optimism or Ethereum Mainnet, and follow the steps to stake SNX and mint sUSD.

Debt Dynamics: Minting sUSD is akin to a loan against your SNX. Your debt varies with the overall debt pool's performance, and trading fees reduce it weekly.

Manage Your Stake:

Hedge Debt: Use dSNX for easy hedging or do it manually.

Maintain C-Ratio: Keep your collateralization ratio balanced to avoid liquidation.

Automate with Gelato: For efficiency, automate staking and minting.

Lock Periods: There's a 7-day lock after minting sUSD or staking SNX.

Unstaking: Burn all sUSD to free your SNX. SNX in escrow can't be moved.

Weekly Rewards: Stay staked before each Wednesday for rewards.

Liquidation Risks: Regularly check your C-Ratio to avoid penalties.

Synthetix Governance:

Synthetix Improvement Proposals (SIPs) describe standards for the Synthetix platform, including core protocol specifications, client APIs, and contract standards.It is hard to play catch up with all the latest SIPs, checkout the latest ones:

SIP-355: Add extra views to Spot Markets - Recap of the presentation.

SIP-2052: List CVX on SNX Perps V2 - Recap of the presentation.

SIP-2050: Deprecate sINR Synth - Recap of the presentation.

SIP-2051: Deprecate Perp Markets with 0 Max Market Value - Recap of the presentation.

SCCP-2077: Activate the MMV Risk Control Module - Recap of the presentation.

SIP-2047: Begin migrating Perps V2 markets - Status: Implemented.

SIP-2049: Begin migrating offchain Perps V2 markets - Status: Implemented.

SCCP-309: Increase Base LP limit to 1M USDC - Status: Draft.

SIP-2048: MaxMarketValue Risk Control Module - Status: Draft.

Community Tweets:

Polynomial: The clan wars have come to an end, and...

Gauthamzzz: you can now trade jito...

PythNetwork: Pyth Data is on the move...

Toros Finance: February 5th. Stay tuned for what's unfolding at Toros...

mastermojo83: What I learned from the @Kwenta_io...

Infinex: Calling all @synthetix_io debt share holders...

Infinex: IR-3: Governance v1.2...

Ecosystem Update

Infinex | Kwenta | Polynomial | Rage Trade | Lyra | Thales

Awesome job gents!