Spartan Research Collective #04

Highlights

Synthetix Perps impresses with a 7-day total volume reaching $678 million, showcasing active market engagement. Bitcoin and Ethereum lead positions amidst BTC's surge to $60,000, stirring interest in market dynamics. Synthetix Loans undergo parameter changes for enhanced stability, while the Pyth Retrospective Airdrop celebrates platform milestones. Excitement brews with the collaboration between Synthetix and Ethena Labs, promising further innovations. Stay tuned as we delve into the dynamic world of decentralized finance, with much more to uncover.

Performance Overview

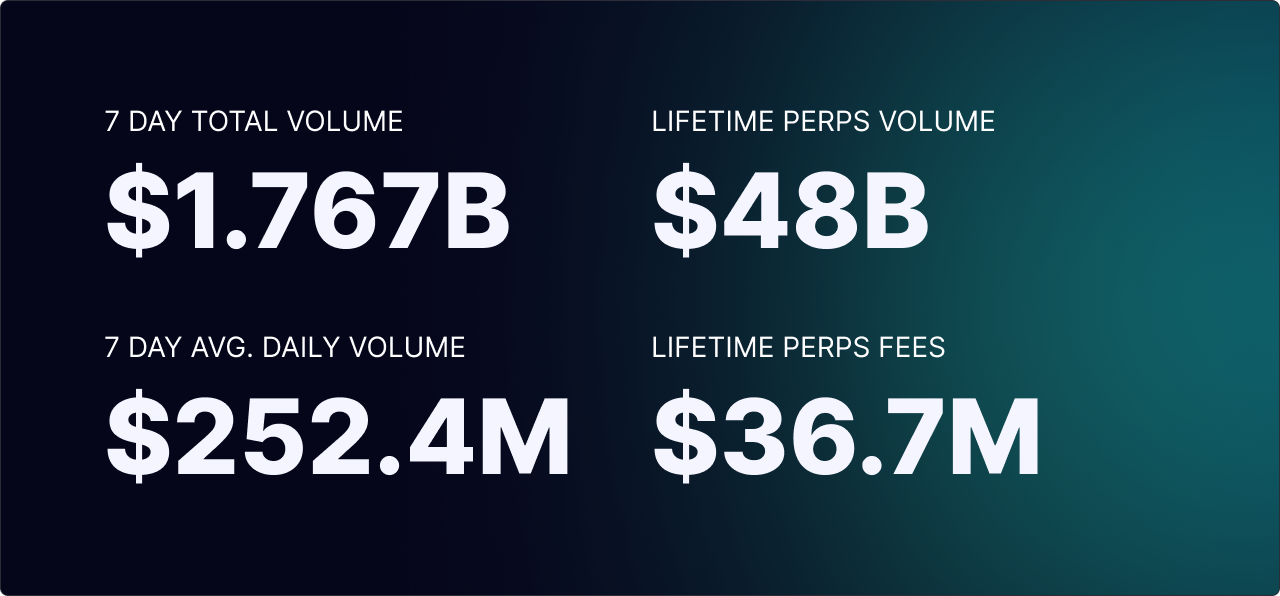

📊 Synthetix Perps Data Report:

- 7-Day Total Volume: $1.767 billion

- Average Daily Volume: $252.4 million

- Lifetime Perps Volume: $48 billion

- Lifetime Fees: $36.7 million

In the past month, Synthetix Perps has shown strong performance in the derivatives market, with a high trading volume that shows a lot of liquidity and trust from its users. The platform has kept up a steady flow of daily trades, supporting its growth. This month's numbers match up with Synthetix Perps' history of having a huge total volume and collecting a lot of fees, proving that users are staying engaged and the market is active.

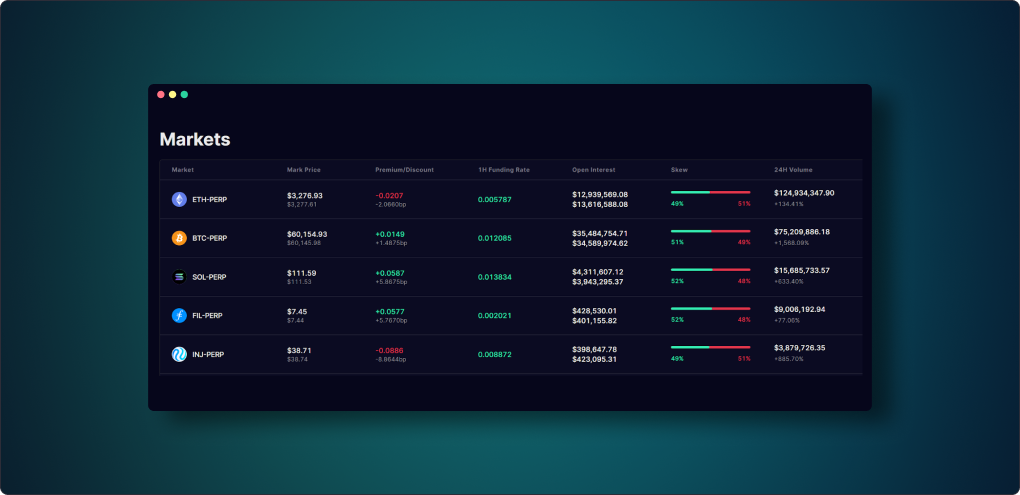

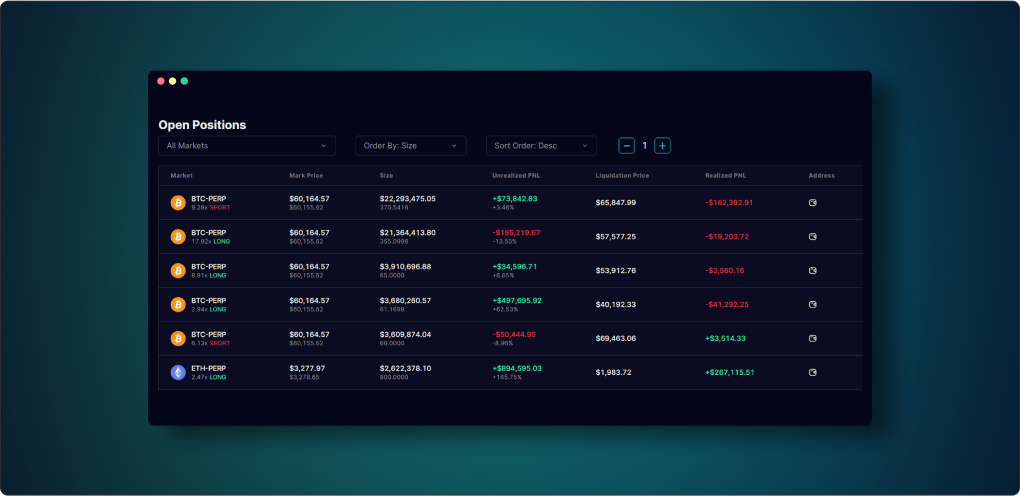

On-Chain Analysis - Follow The Whales

If you're new to Onchain Trading, you have the option to track your preferred wallet and observe their market trading strategies. The Synthetix Perps "Watcher" website serves as an excellent resource for traders on their journey. You can check it out here: watcher.synthetix.io/positions.

This month, the most significant positions held on Synthetix Perps have mainly been in BTC and ETH. In the last 30 days, In just the past week, BTC's value has surged by almost 20%. Currently, the funding rate for BTC stands at 106%. Remarkably, BTC has reached the $60,000 mark!

Parameter Changes for Synthetix Loans

In a significant update, Synthetix has announced changes to its loan parameters following the adoption of SCCP-2081. Starting March 1st, the platform will increase interest rates and issuance fees on existing sUSD and sETH loans, marking a shift towards aligning with market rates after nearly a year of disabling new loans.

Despite the pause on new borrowing, a substantial amount of debt in sUSD and sETH, backed by ETH collateral, remains outstanding. To address this and encourage loan repayment, Synthetix is making key adjustments:

Issue Fee Rate Increase: Immediate implementation of a 1% fee for issuing sUSD and sETH against existing ETH collateral, up from virtually 0%.

Borrow Rate Increase: Set for March 1st, the annual interest rate on existing loans will rise to 30%, providing borrowers ample time to settle their loans to avoid the new charges.

These measures aim to motivate the repayment of the outstanding $1.7 million in sUSD and 2,697 sETH loans, stabilize the sUSD peg, and prepare for the integration of a more efficient CDP loan system in the upcoming Synthetix V3 architecture. Importantly, these changes will not affect stakers, only borrowers using ETH collateral.

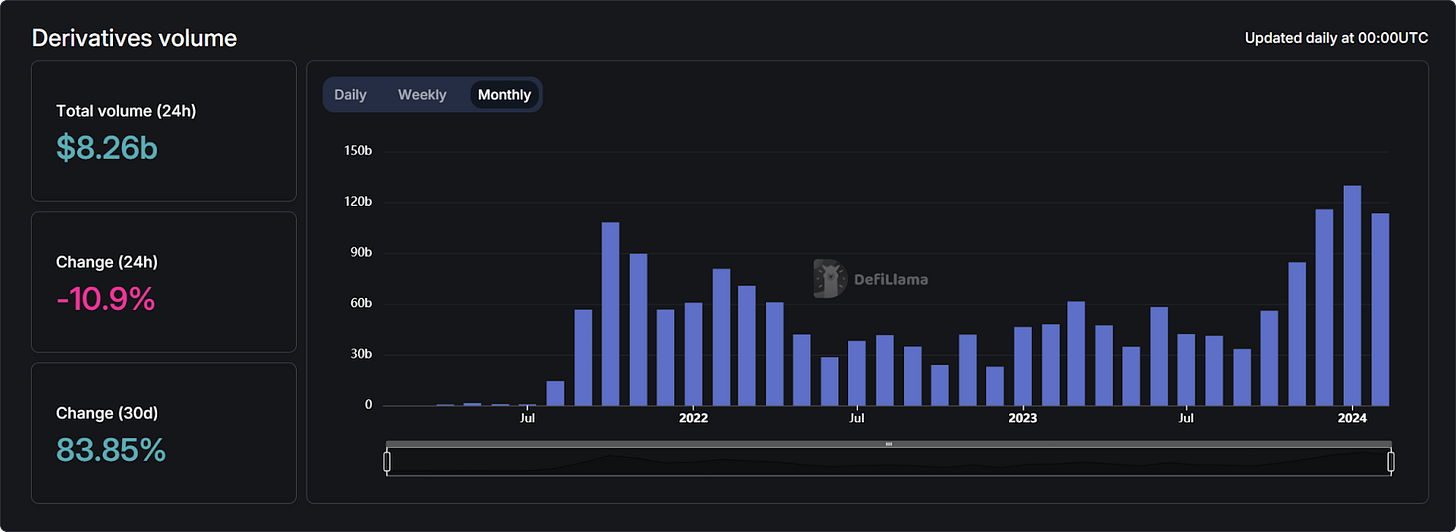

DEFI Corner

In this section we will briefly discuss DEFI Options and Perpetuals in the on-chain space.

DEFI Perpetuals:

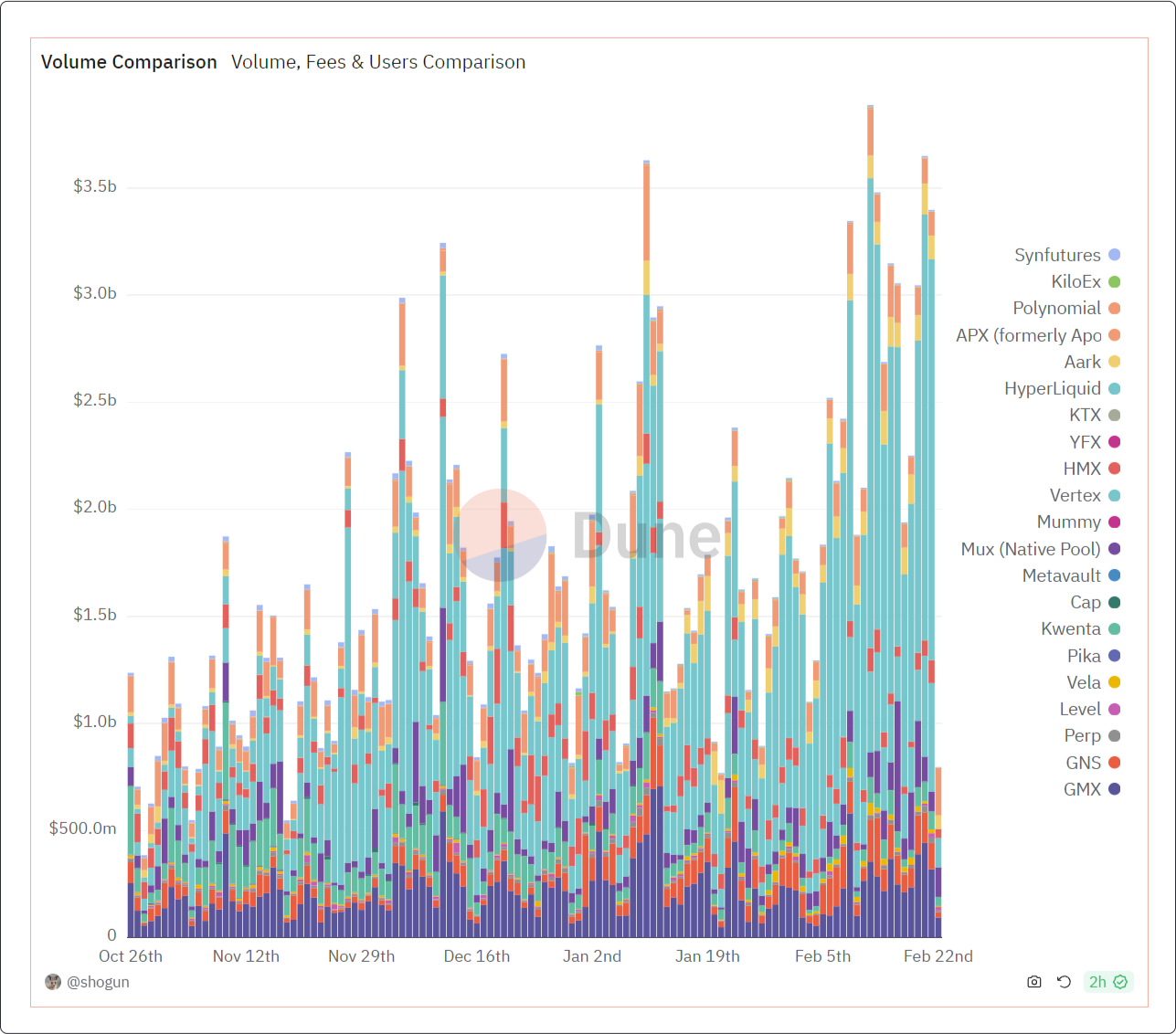

Top On-Chain Perp Protocols this week by volume:

Optimism: Kwenta, Mux Protocol Polynomial

Base: IntentX, Basedmarkets

Arbitrum: Hyperliquid, Vertex

Ethena and Synthetix

Ethena Labs is developing a decentralized stablecoin, USDe, on Ethereum, aiming to offer a crypto-native financial solution independent of traditional banking. Synthetix is thrilled to announce a collaboration with Ethena to integrate its first decentralized perpetuals exchange, leveraging Synthetix for collateralization of USDe.

The choice to build on Synthetix is strategic, considering the platform's capability to offer deep on-chain liquidity and access to Ethereum's Layer 1 liquidity, crucial for operations and the successful deployment of USDe. Synthetix's advancements, particularly with version 3, align with goals by providing a flexible and efficient framework for liquidity deployment and introducing diverse forms of collateral.

Ethena plans to serve as a liquidity provider on Synthetix, using USDe as a margin instrument and approved collateral. This integration is expected to benefit both platforms significantly. For Synthetix, Ethena's stablecoin and volume contributions will enhance liquidity and create a more attractive environment for traders.

Looking ahead, Ethena is set to conduct internal testing of the delta-neutral USDe strategy with selected partners. This phase will ensure smooth integration with Synthetix perpetuals, marking a significant step towards providing a scalable, stable, and censorship-resistant financial solution on the blockchain.

Synthetix Governance

Synthetix Improvement Proposals (SIPs) describe standards for the Synthetix platform, including core protocol specifications, client APIs, and contract standards.It is hard to play catch up with all the latest SIPs, checkout the latest ones:

SIP-360: Synthetix V3 Cross-chain Elections System - Status: draft

SIP-354: Perps V3 Asymmetric Funding - Status: draft

SIP-2054: List PENDLE on SNX Perps V2 - Status: draft

SIP-357: Chainlink Node with Staleness Check - Status: draft

SIP-358: Introduce ‘lockedOiMultiple’ to Perps V3 - Status: draft

SIP-359: Perps V3 — Bypass Checks on Position Risk Reduction - Status: draft

SIP-355: Add extra views to Spot Markets - Status: approved

SIP-2052: List CVX on SNX Perps V2 - Status: approved

SIP-2050: Deprecate sINR Synth - Status: implemented

SIP-2051: Deprecate Perp Markets with 0 Max Market Value - Status: approved

SCCP-2077: Activate the MMV Risk Control Module - Status: approved

Community Tweets

ΔLΞXΔNDΞR | Bet More: The @synthetix_io L1 perpetual will be the cheapest...

Vance Spencer: Ethena using SNX V3 is going to be one of the coolest...

Synthetix: Stake $SNX on Optimism or Ethereum to receive weekly fees...

MattLosquadro: synthetix perps is - live on @Optimism via perps v2...

TLX: Introducing TLX: The leveraged tokens protocol powered by @synthetix_io...

Infinex: Calling all @synthetix_io debt share holders...

Pyth Network: @synthetix_io is #PoweredByPyth...

Synthetix Ambassadors: SNX Ambassadors Project Spotlight: @dHedgeOrg!...

Ecosystem Update

Infinex | Kwenta | Polynomial | Rage Trade | Lyra | Thales | Toros | Pyth