Spartan Research Collective #06

Highlights

✨This Month's Highlights

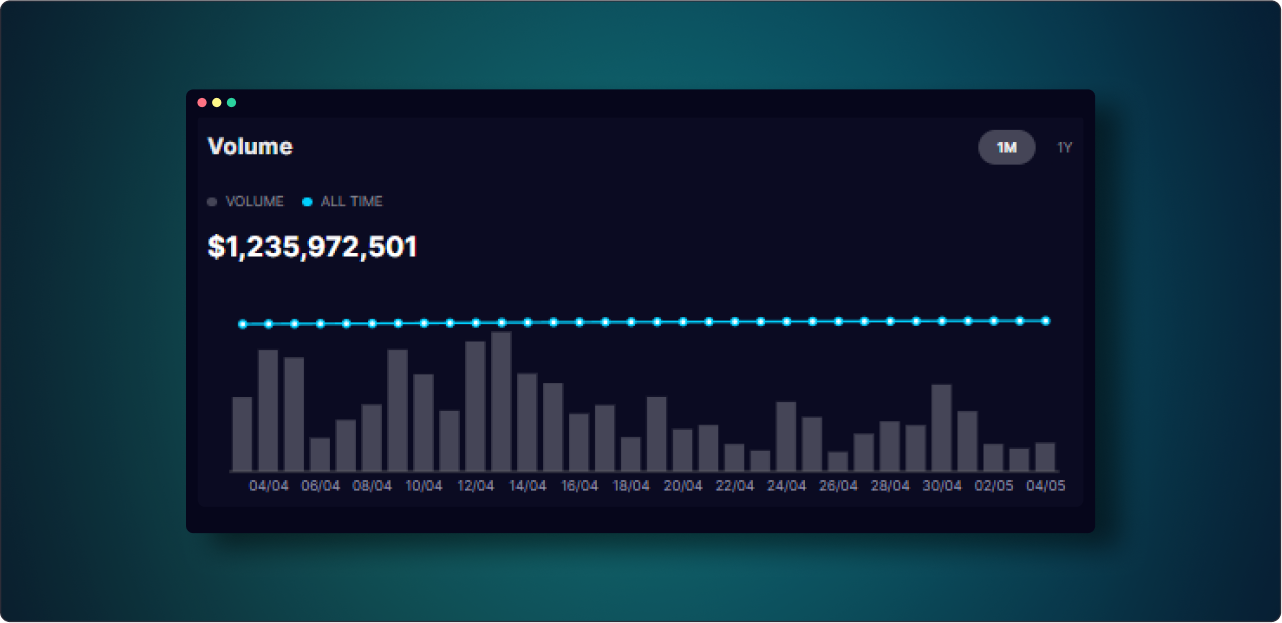

Synthetix Perps Strong Performance: With a total volume reaching $1.2 Billion this month, Synthetix Perps are not slowing down!

Ethereum's Market: Watch for significant movements as the largest Ethereum short position stands at $2.49 million with an entry at $1,700.

Synthetix V3 Launch on Base: Synthetix V3 is now live, offering enhanced opportunities for liquidity providers and traders on the Base platform.

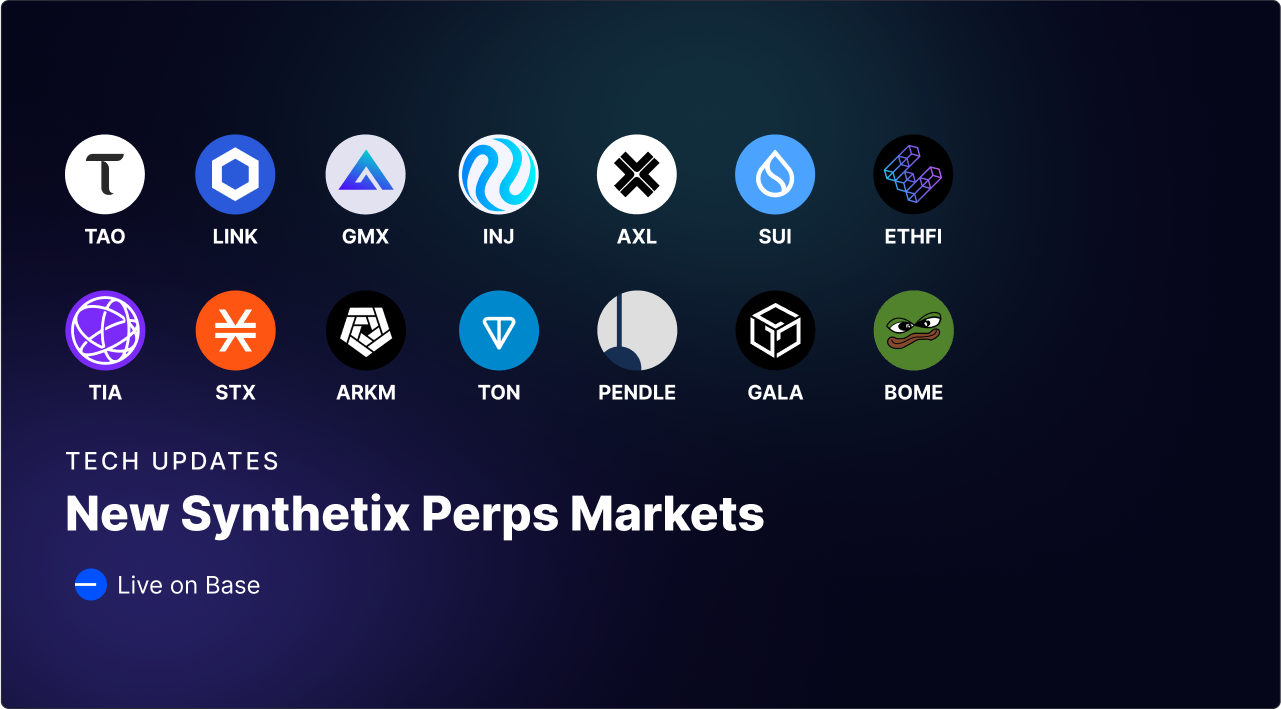

Expansion of Perpetual Futures Markets: Introduction of 30 new perpetual futures markets on Base, including innovative assets like Bittensor (TAO) and Chainlink (LINK).

Incentive Programs Rollout: New USDC and SNX incentive programs aimed to boost liquidity and market engagement on Synthetix V3.

Let’s dig in 👇

Performance Overview

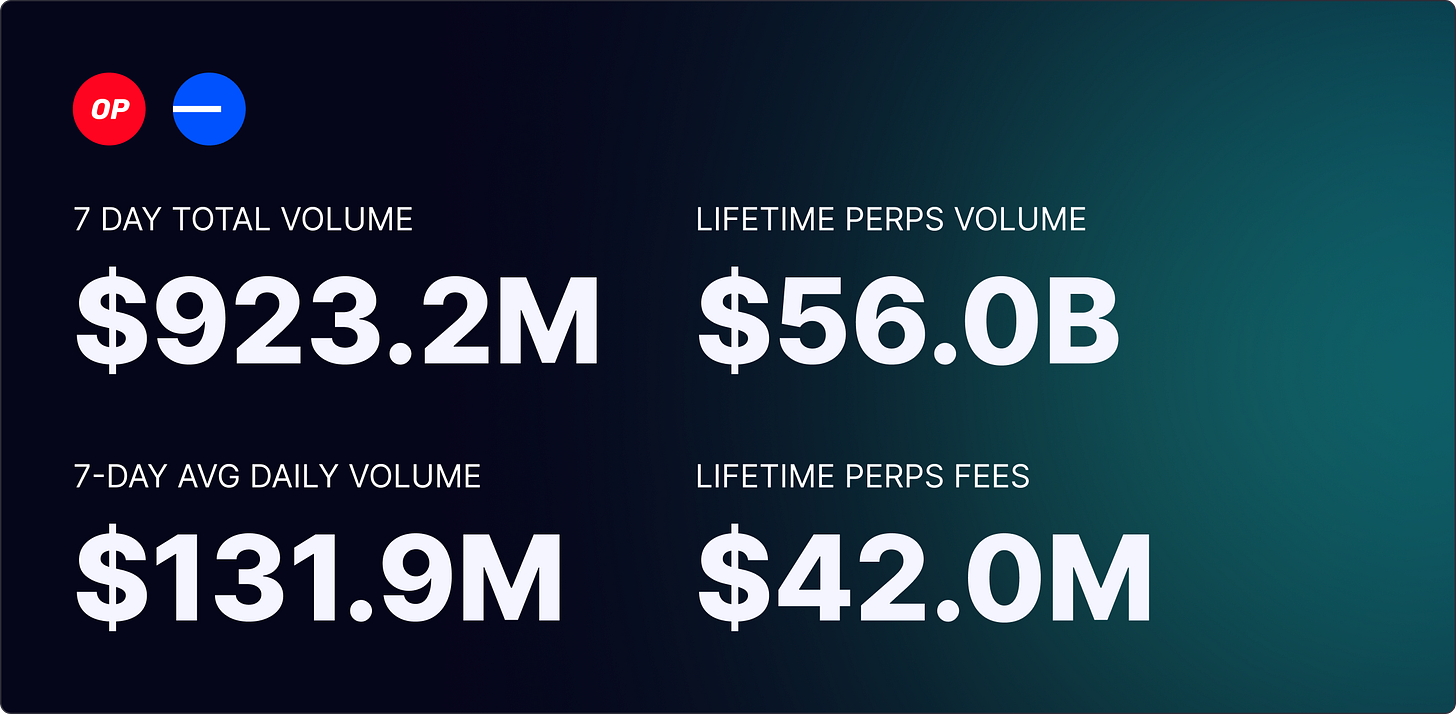

Synthetix Perps Data (May 13th - May 20th)

- Total Volume: $923.2M (OP: $636M, Base: $287.2M)

- Avg Daily Vol: $131.9M (OP: $90.9M, Base: $41.0M)

- Lifetime Vol: $56.0B (OP: $54.7B, Base: $1.23B)

- Lifetime Fees: $42.0M (OP: $41.6M, Base: $419.1K)

In the past month, Synthetix Perps has shown strong performance, with a high trading volume Synthetix Perps remain as one of the most popular on chain Perp providers.Over the last 30 days, Synthetix Perps has seen a total trading volume of $1.2 billion. The platform also collected $906,000 in fees from around 30,000 trades completed by approximately 5,600 traders. This activity highlights the platform's strong performance and the trust it has earned from its users.

🐋 On-Chain Analysis - Follow The Whales

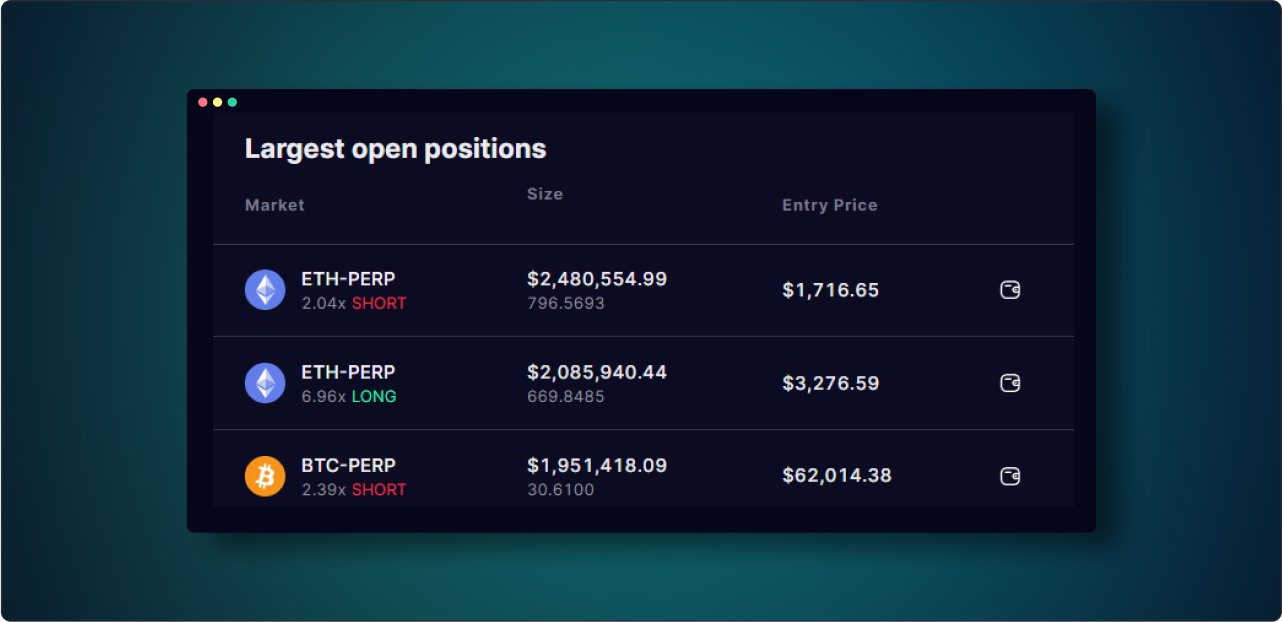

In the recent cryptocurrency market, Bitcoin (BTC) exhibited extreme volatility, reaching a peak of $72,000 before experiencing a significant decline to $57,000. The current open interest for both BTC and Ethereum (ETH) exceeds $22 billion, highlighting significant engagement from traders.

Notably, the largest open position is an Ethereum short valued at $2.49 million, with an entry price at $1,700. This position might pose considerable risks for the trader, especially if the market rebounds or does not move in the anticipated direction. As ETH is currently priced far outside of the entry price at $3,100, it is interesting what their next move will be.

Furthermore, the introduction of new markets in April has generated numerous intriguing trading opportunities, particularly with Synthetix perpetual contracts. These developments provide traders with various avenues to explore, ranging from potential high-risk and high-reward positions to more conservative strategies. Let's keep an eye on this position in the next edition and see what happens 👀.

Synthetic V3 is live on Base

Synthetix V3 has officially launched on Base, presenting users with opportunities to become liquidity providers, earn trading fees, and benefit from USDC/SNX LP incentives. By supplying USDC collateral to the Spartan Council Pool, participants can receive a portion of Perps trading fees and qualify for additional incentives from the Synthetix Treasury Council.

As liquidity on Synthetix V3 grows, it will support increased open interest and the introduction of new markets, enriching the ecosystem. To begin as an LP and explore incentive programs, users can follow the instructions provided in the "Providing Liquidity" and "Earning SNX & USDC LP Incentives" sections below.

Innovations introduced in Perps V3 include native cross-margining, configurable liquidations, improved settlements, and NFT-controlled accounts, enhancing both liquidity provider and trader experiences. Further developments and improvements are anticipated as Synthetix refines its V3 contracts and expands on Base, with ongoing adjustments to governance parameters and fee distribution.

USDC & SNX LP Incentives on Base

Synthetix is introducing incentive programs for USDC and SNX on Base to enhance liquidity provider collateral, which is essential for the expansion of Synthetix V3 and Perps V3.

Additionally, SNX incentives detailed in STP-14 will distribute 225,000 SNX over 10 weeks to incentivize USDC deposits on Base Andromeda. These rewards will attract USDC deposits to the Spartan Council Pool, with proportional allocation over the ten-week period, including a one-time distribution and weekly distributions.

To participate, users can follow the V3 Base LP Guide and deposit USDC collateral. Increased USDC collateral will enable Synthetix to support more perps markets and open interest, subject to governance approval. Currently, users can only deposit USDC to earn fees without minting stablecoins, with a 24-hour withdrawal lock-in period.

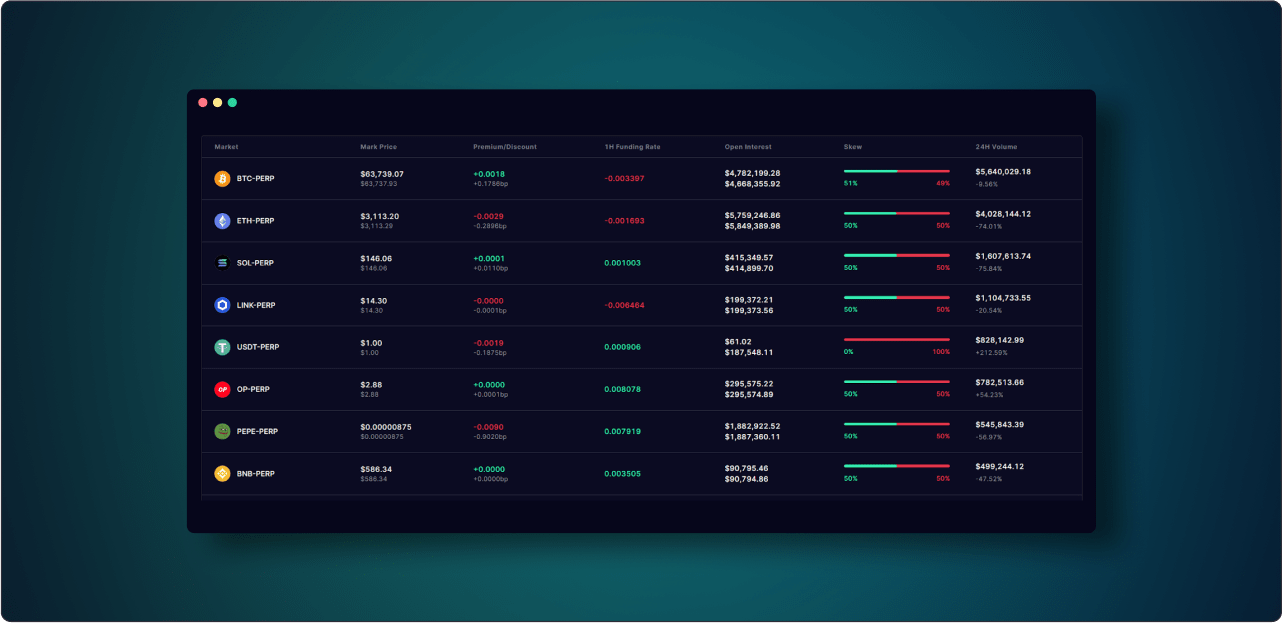

Synthetix Perps Launches 30 New Perpetual Futures Markets on Base

Synthetix is excited to announce the launch of new perpetual futures markets on Base, expanding its offerings to include assets such as Bittensor (TAO) and Chainlink (LINK). Approved in SIP-370, SIP-372, SIP-375, SIP-379, and SIP-380, these markets come with parameters set by SCCP-327, ensuring a diverse trading experience. Accessible exclusively via Synthetix Perps on Base, traders can leverage platforms like Kwenta to engage with these markets, opening up new avenues for investment and speculation.

Synthetix Perps relies on liquidity providers to support perps liquidity. By providing liquidity to the new Spartan Council Pool, LPs can earn a portion of the trading fees generated by the protocol. Additionally, Synthetix currently offers liquidity incentives in the form of SNX/USDC rewards for LPs in addition to the regular perps trading fees.

More liquidity in these markets will enable higher open interest, increased trading volumes, and the potential for additional markets to be launched on Synthetix Perps.

🔎 Synthetix Governance:

Synthetix Improvement Proposals (SIPs) describe standards for the Synthetix platform, including core protocol specifications, client APIs, and contract standards.It is hard to play catch up with all the latest SIPs, checkout the latest ones:

SCCP-327: Enable Perps V3 Markets / Update Parameters, Status: vote pending

SIP-377: Add aUSDc (stataUSDc) as a new collateral type to Synthetix V3 on Base, Status: approved

SIP-378: Perps V3 — Integrator Requests & Improvements, Status: approved

SIP-306: V3 Migration, Status: approved

SIP-376: List 11 markets from Perps V2 on Perps V3 on Base, Status: approved

SIP-373: Preemptive Approval for Listing ENA Token on Perps V3 on Base, Status: approved

SIP-374: Preemptive Approval for Listing DEGEN Token on Perps V3 on Base, Status: approved

SIP-375: List BOME-PERP and ETHFI-PERP on Perps V3 on Base, Status: approved

SIP-364: Reconfigure Grants Council, Status: implemented

SIP-367: Synthetix V3 Deployment to Arbitrum, Status: approved

SIP-360: Synthetix V3 Cross-chain Elections System, Status: approved

SIP-341: Add Configurer Address, Status: approved

SIP-371: Add sUSDe LP collateral support to Synthetix V3 on Arbitrum, Status: draft

SIP-369: Remove Maximum Rewards Distributors Limit, Status: approved

SIP-2059: Legacy Spot Synth Migration, Status: approved

SCCP-2093: Update of sETH Exchange Fees, Status: vote pending

SCCP-2094: Increase wETH Wrapper maxTokenAmount, Status: vote pending

SCCP-2095: Deprecate V2 Legacy Loans/Wrappers, Status: vote pending

🤝Community Tweets:

https://x.com/mastermojo83/status/1786074022209343590

https://x.com/KemarTiti/status/1784926113753604143

https://x.com/0x_____________/status/1781448347066261611