Spartan Research Collective #07

Highlights

✨This Month's Highlights

Let’s dig in 👇

Choppy Market Conditions: Bitcoin (BTC) is currently above $69,000, and Ethereum (ETH) is above $3,600, reflecting a choppy market with no significant trends.

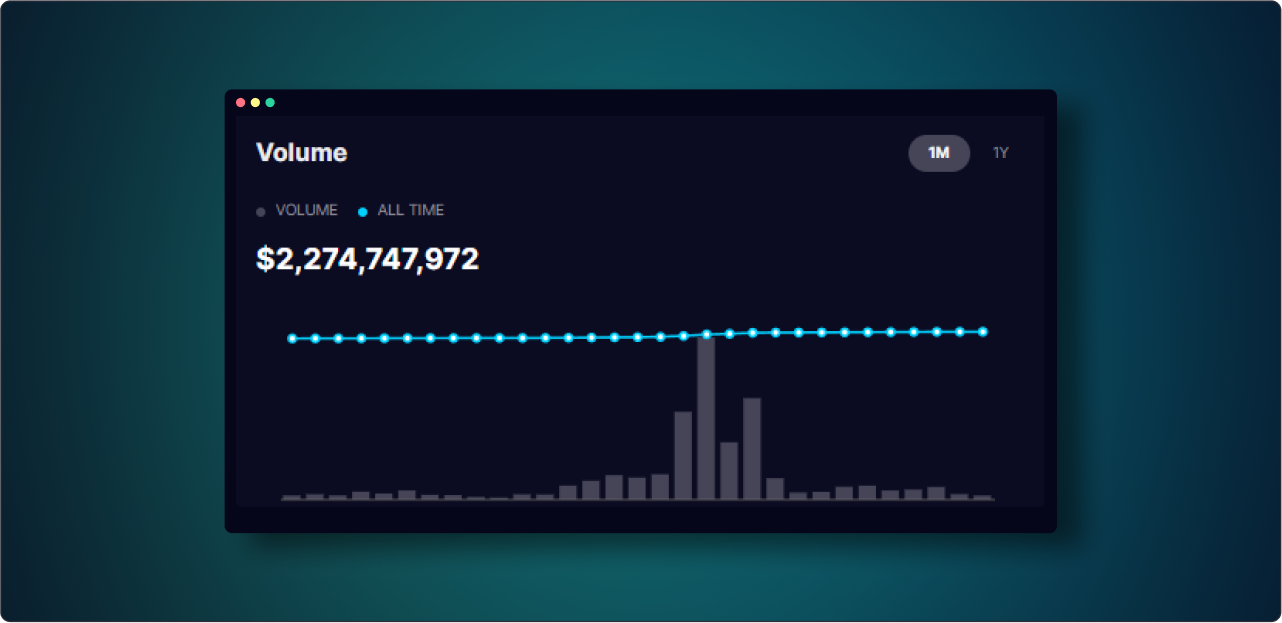

Synthetix Perps Performance: Synthetix Perps achieved a total trading volume of $1.44 billion last month, with an average daily volume of $205.9 million, solidifying its leading position in on-chain perpetual trading.

Pyth Governance Distribution: Eligible Synthetix users can now claim Pyth tokens to support early governance stages, enhancing the Synthetix-Pyth partnership.

500k SNX Fee Rebates: Synthetix announces a new SNX incentive program starting May 22, 2023, offering up to 500,000 SNX in fee rebates to boost perps trading on Base.

Performance Overview

📊 Synthetix Perps Data

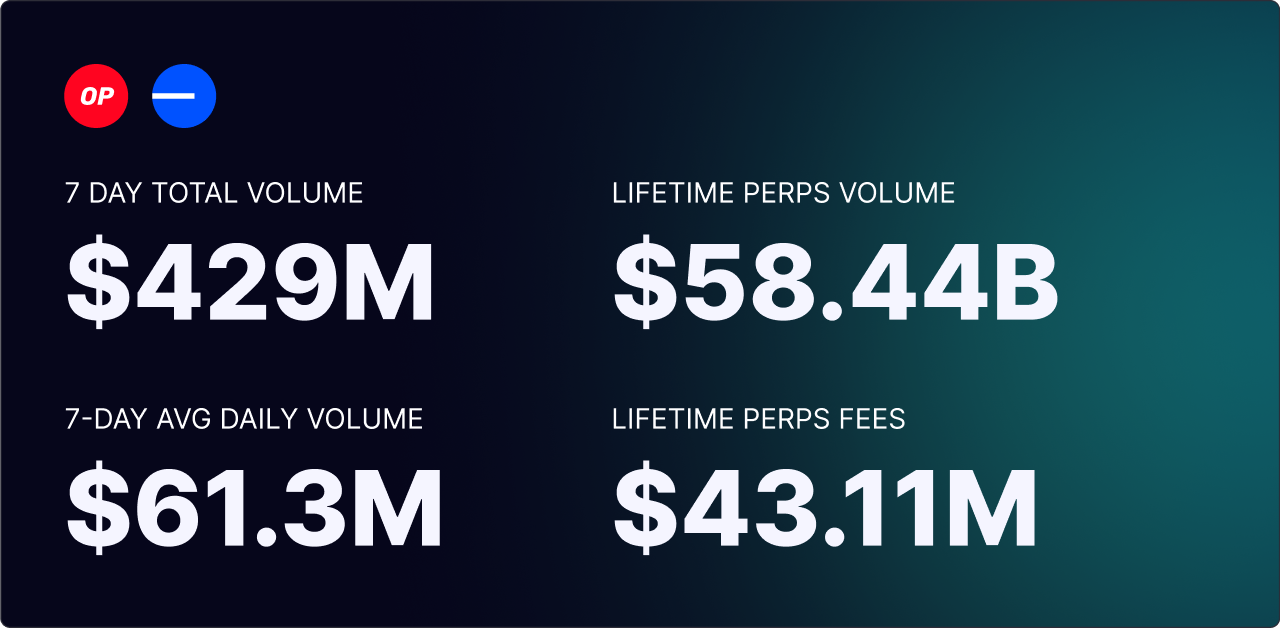

- Total Volume: $429M (OP: $295M, Base: $134M)

- Avg Daily Vol: $61.3M (OP: $42.1M, Base: $19.1M)

- Lifetime Vol: $58.44B (OP: $56.65B, Base: $1.79B)

- Lifetime Fees: $43.11M (OP: $42.52M, Base: $591K)

In the last month, Synthetix Perps has continued to demonstrate robust performance with a significant uptick in trading volume, solidifying its position as a leading on-chain perpetual trading provider. Over the past 30 days, the platform has handled a total trading volume of $429M, comprising $295M from options (OP) and $134M from base trading. The average daily volume has reached an impressive $61.3M, with options contributing $42.1M and base trading adding another $19.1M.

Moreover, Synthetix Perps has achieved a lifetime trading volume of $58.44B, with options trading accounting for $56.65B and base trading $1.79B. The platform has also accrued substantial fees amounting to $43.11M over its lifetime, including $42.52M from options and $591K from base trading.

🐋 On-Chain Analysis - Follow The Whales

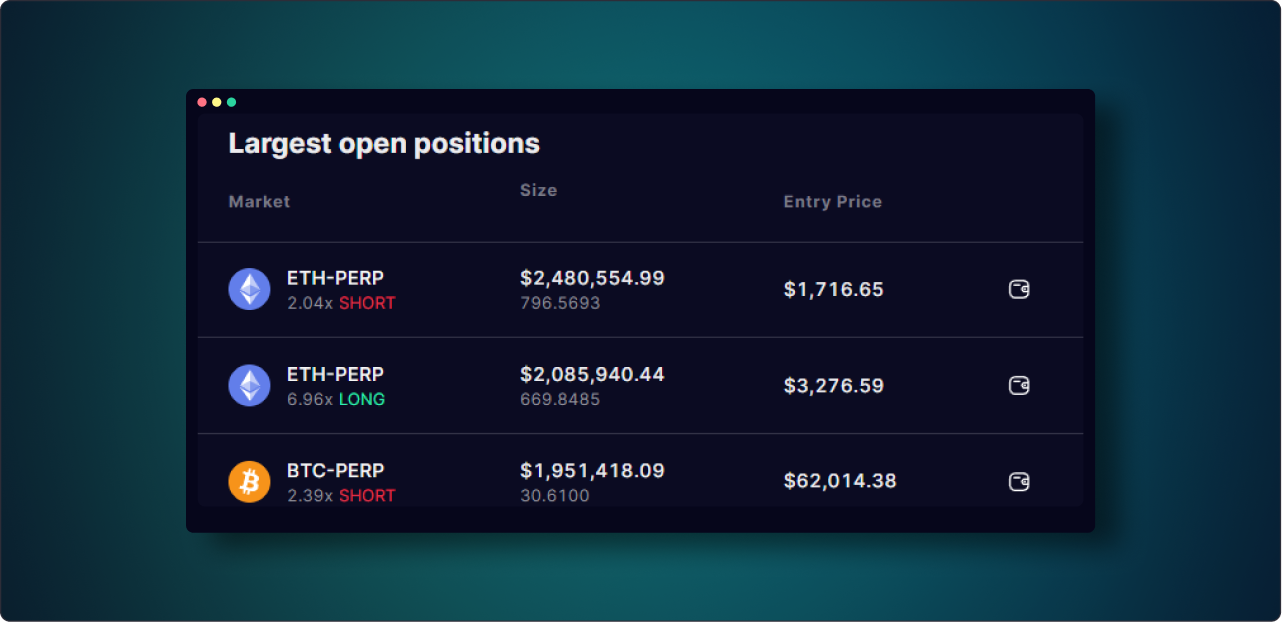

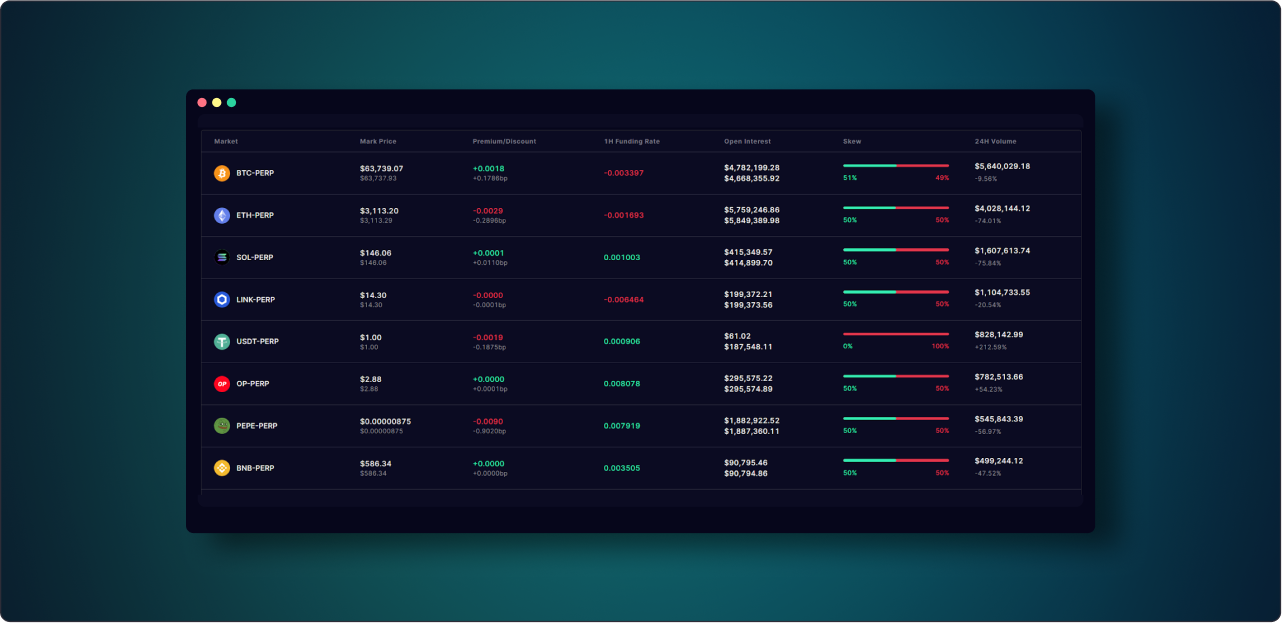

In the recent cryptocurrency market, Bitcoin (BTC) has remained above $69,000. Ethereum (ETH) has also remained stable, currently priced above $3,600. The open interest for both BTC and ETH remains robust, exceeding $40 billion, a significant increase from the prior month of almost 100%.

Notably, the largest open position at the moment is an Ethereum position valued at $10.9 million. The funding rate currently isn't necessarily skewed, suggesting a balanced sentiment in the market. However, despite these movements, the market has been choppy with not much happening in terms of significant trends or events.

With the wider stock market being volatile, theres a lot of potential for the upcoming months to experience some volatility in the crypto market 👀

Pyth Governance Distribution Now Live for Eligible Synthetix Users

We're thrilled to launch the Pyth Governance Distribution! Eligible members can now claim their Pyth tokens to support Pyth’s early governance stages and strengthen the Synthetix-Pyth partnership.

Eligibility for Pyth Token Claim

You may qualify if you’ve engaged in the past year by:

Participating in governance channels like #governance and #spartan-council on Discord.

Voting on Synthetix Improvement or Configuration Change Proposals.

Serving on any Synthetix DAO.

Authoring governance proposals.

Staking SNX & engaging in Synthetix governance elections.

How to Claim

To claim your tokens:

Visit https://app.streamflow.finance/airdrop with your registered Solana wallet.

Sign in and verify your wallet.

Navigate to the airdrops page to see the Pyth Governance Distribution airdrop.

Claim your tokens.

With your new tokens, join Pyth’s journey in decentralized governance:

Check out the Pyth Staking and Voting Guides.

Join the conversation on Pyth Discord.

Onchain Summer with Base: Powered by Synthetix

This summer, Synthetix is excited to sponsor the finance and trading tracks at the Base Onchain Summer Buildathon. With the successful deployment of Synthetix V3 on Base, we're eager to see new innovations in user experience and financial mechanisms from the Base builders.

Why Participate with Synthetix?

Comprehensive Tools: Extensive documentation and support through the Cannon deployment tool.

Access to Funding: Opportunities to apply for ongoing project funding through the Synthetix Ecosystem Fund.

Exclusive Invites: Participants receive invites to the Synthetix party at ETH CC in Brussels.

Get Started:

Jump into building with Synthetix by visiting our developer docs at Synthetix V3 Developer Docs.

Project Ideas:

Integrate with perpetual futures markets.

Develop new derivative or finance apps utilizing Synthetix liquidity.

Create personal or business finance applications integrated with Synthetix V3.

500k SNX Fee Rebates for Trading Perps V3 on Base

Synthetix is thrilled to announce a new SNX incentive program starting May 22, 2023, aimed at boosting perps trading on Base. This initiative will provide fee rebates to attract new traders and increase trading volume.

Program Overview:

SNX Allocation: Up to 500,000 SNX is reserved for fee rebates.

Rebate Details: Traders can receive a 90% rebate on fees, capped at 50k SNX per week, distributed on a first-come, first-served basis.

Duration: The program kicks off on May 22 and is slated to run for a minimum of 10 weeks, with extensions possible if the allocated SNX is not fully utilized.

Objectives & Governance:

The goal is to onboard new traders, generate more fees, and attract new liquidity, enhancing Synthetix Perps as a leading DEX on Base. The Treasury Council retains the right to adjust or suspend rebates to ensure the platform's integrity and to prevent practices like wash trading.

Impact & Distribution:

Building on the success of previous incentives, this program is expected to significantly enhance trading activity. Rewards are calculated weekly based on trading activity from Tuesday to Tuesday, with distributions following shortly after each period ends.

Transitioning to Synthetix V3: Scaling sUSD & Migrating SNX

Synthetix is embarking on a crucial phase with the rollout of V3, introducing a revamped foundation and architecture that enhances the scalability and decentralization of its stablecoin, sUSD.

Key Updates in V3:

Shift from Inflationary to Real Yield: Synthetix V3 is moving away from minting SNX for incentives and now focuses on generating real yield from trading fees for liquidity providers and implementing a buyback-and-burn mechanism for SNX.

Expanded sUSD Collateralization: V3 broadens sUSD backing to include SNX, ETH, USDC, and other approved tokens, increasing stability and scalability.

Simplified Participation: V3’s design simplifies engaging with Perps & Spot Markets, making it easier for users to participate.

Migration Plan:

Increased Liquidity Incentives: Boosts for liquidity on Velodrome and Curve to support smooth migration.

Phased Migration: Begins with Ethereum Mainnet in June, followed by Optimism.

SNX and sUSD Migration: Seamless transition of SNX and migration to a new sUSD token, ensuring continuity and robustness.

This upgrade aims to strengthen Synthetix as a leading platform in decentralized derivatives and stablecoins, focusing on long-term sustainability and growth.

🔎 Synthetix Governance:

Synthetix Improvement Proposals (SIPs) describe standards for the Synthetix platform, including core protocol specifications, client APIs, and contract standards.It is hard to play catch up with all the latest SIPs, checkout the latest ones:

SIP-384: Synthetix OP SNX Appchain - Status: Approved

SIP-383: Multi-Collateral Margin Support — Perps V3 - Status: Vote Pending

SIP-382: List FRIEND-PERP on Perps V3 on Base - Status: Draft

SIP-381: Pool Owner Rewards Distribution Control - Status: Approved

SIP-378: Perps V3 — Integrator Requests & Improvements - Status: Approved

SIP-377: Add aUSDc (stataUSDc) as a new collateral type to Synthetix V3 on Base - Status: Approved

SIP-360: Synthetix V3 Cross-chain Elections System - Status: Approved

SIP-306: V3 Migration - Status: Approved

SCCP-327: Enable Perps V3 Markets / Update Parameters - Status: Vote Pending

🤝Community Tweets:

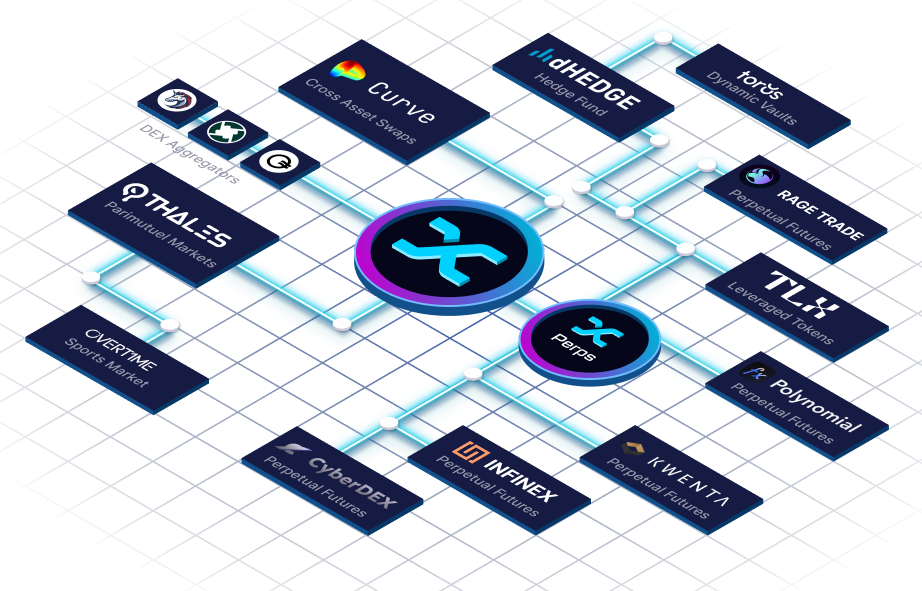

Kwenta | Polynomial | Rage Trade | Lyra | Thales | Toros | Pyth