Spartan Research Collective #08

Highlights

✨This Month's Highlights

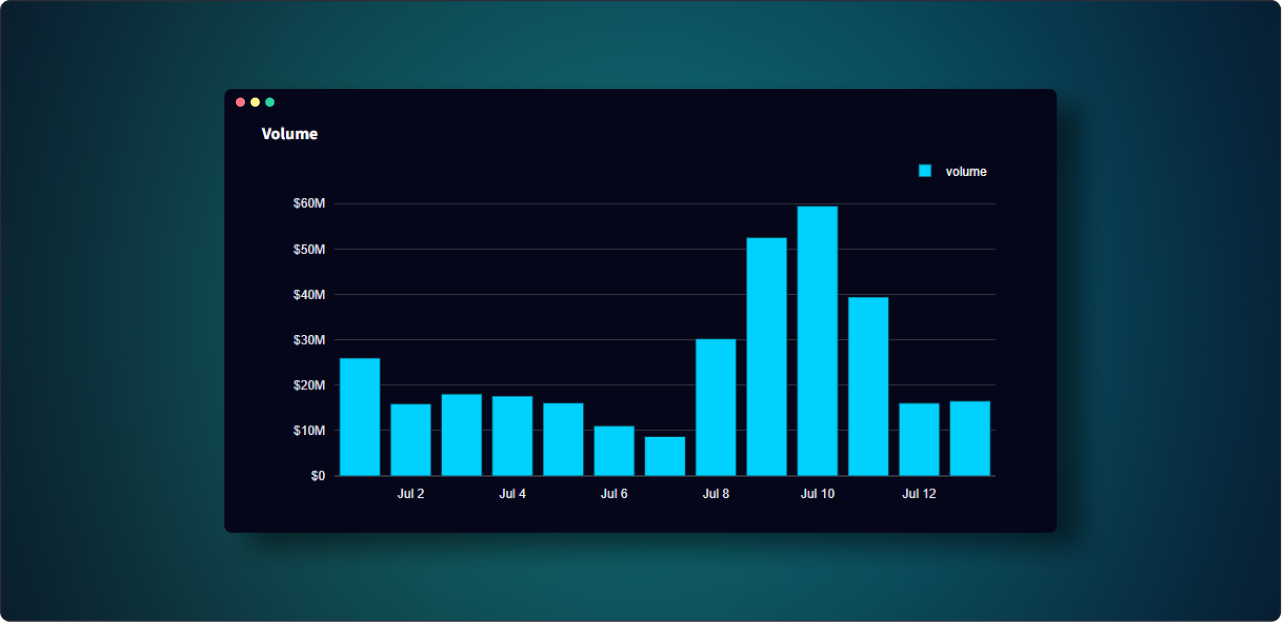

Synthetix Perps V3 Achievements: Reached a cumulative volume of $2.4 billion and generated over $750,000 in fees, with an average volume of $36 million over the past 30 days and $40 million over the last 7 days.

Program Details: A 12-week program distributing 2,000,000 $ARB, with rewards for LP incentives, trading fee rebates, and stablecoin liquidity. Participation includes depositing USDC, ETH, ARB, and Ethena USDe on Synthetix Liquidity, providing liquidity to USDx/USDC pools on Ramses DEX, and earning trading fee rebates.

Recent SIPs: Key proposals include SIP-396 (listing new perps), SIP-395 (P2P Settlement Strategy), SIP-394 (delegate governance power from collateral tokens), and SIP-393 (launch Degenthetix on Base).

Synthetix Quarterly Report: The Quarterly Report for Synthetix, Quarter 2 of 2024: April — June is now out!

Performance Overview

Synthetix has achieved significant milestones with its Perps V3 platform, reaching a cumulative volume of $2.4 billion and generating over $750,000 in cumulative fees. V3 has maintained strong performance, with an average daily volume of $36 million over the past 30 days and $40 million over the last 7 days.

🐋 On-Chain Analysis - Follow The Whales

In the recent cryptocurrency market, Bitcoin (BTC) has experienced some significant volatility and has reached $55k but in recent days has touched $66,000 again. Ethereum (ETH) has also been volatile, currently priced around $3,500.

In terms of market positioning, the open interest for Bitcoin (BTC) seems fairly balanced with approximately 50% each way in open interest for longs and shorts. A similar story is shown with the ETH charts. With the recent ETF announcement volatility should be expected. ⚠️

To learn more Synthetix stats and follow what the whales are doing, check out the Synthetix stats page.

In recent market news, the German government has sold all their Bitcoin holdings, leaving their wallet empty. This might also shed light on the recent BTC price fluctuations. The combination of this development and the upcoming MT GOX payouts has fueled speculation about Bitcoin's future price movements.

Synthetix Launches Arbitrum Liquidity Incentive Program with 2M ARB Rewards

Synthetix is expanding its Arbitrum deployment with a new 12-week Liquidity Incentive Program (LTIP), approved by Arbitrum governance, distributing 2 million $ARB to attract liquidity providers, stablecoin liquidity, and Perps trading activity until September 3rd.

Program Highlights:

Total Rewards: 2,000,000 $ARB

Distribution Breakdown:

1,000,000 ARB for LP incentives

900,000 ARB for trading fee rebates (up to 75% of trading fees)

100,000 ARB for stablecoin liquidity

Weekly Distribution Schedule:

LP incentives and stablecoin liquidity rewards start from June 18.

Trading fee rebates begin from July 26.

Participation Details:

LP Incentives: Deposit USDC, ETH, ARB, and Ethena USDe (coming soon) on Synthetix Liquidity.

Stablecoin Liquidity: Provide liquidity to USDx/USDC pools on Ramses DEX.

Trading Perps: Earn trading fee rebates when Perps trading goes live, with additional staking rewards from a Synthetix and Pyth campaign.

Synthetix Quarterly Report — Q2 2024

The past few months have been a period of dynamic growth and strategic expansion for Synthetix, underscored by the successful launch of Synthetix V3 on Base and Arbitrum, and a series of exciting new market listings and incentive programs. As we navigate these changes, let’s take a moment to review some of the key highlights and challenges faced by the Synthetix Protocol in Q2.

👉Q2 Highlights

⭐ Spartan Council/CCs: V3 Scaling & Arbitrum Deployment

⭐ Ambassador Council: OP Grants

Checkout the full Quarterly Report here: https://blog.synthetix.io/synthetix-quarterly-report-q2-2024/

🔎 Synthetix Governance:

Synthetix Improvement Proposals (SIPs) describe standards for the Synthetix platform, including core protocol specifications, client APIs, and contract standards.It is hard to play catch up with all the latest SIPs, checkout the latest ones:

SIP-396: List ONDO, PEOPLE, IO, ENS, ZK, AR, ZRO, and AEVO perps

SIP-395: P2P Settlement Strategy

SIP-394: Delegate governance power from collateral token deposited in Synthetix

SIP-393: Launch Degenthetix on Base, Status: draft

SIP-392: Support Ethena USDe as LP Collateral, Status: draft

SIP-391: Liquidations on Synthetix using Pyth’s Express Relay, Status: draft

SIP-390: Minimum Credit Patch — Perps V3, Status: approved

SIP-389: Adding Support for Yield Tokens from Aave and Lido to Arbitrum V3 LP, Status: approved

SIP-388: Adding Support for EtherFi weETH to Arbitrum V3 LP, Status: approved

SIP-387: Create a new perps market listing framework for automated listing across all networks, Status: vote pending

SIP-386: Bring perps V3 markets to parity with perps V2, Status: draft

SIP-385: Arbitrum perps V3 fee model, Status: draft

SIP-383: Multi-Collateral Margin Support — Perps V3, Status: approved

SIP-367: Synthetix V3 Deployment to Arbitrum, Status: approved

SIP-366: Asynchronous Delegation, Status: approved

SIP-360: Synthetix V3 Cross-Chain Elections System, Status: approved

SIP-341: Add Configurer Address, Status: approved

SIP-306: V3 Migration, Status: approved

🤝 Community Tweets:

https://x.com/llamaonthebrink/status/1808207163690459266

https://x.com/mastermojo83/status/1808125182067806338

https://x.com/RamsesExchange/status/1805631956354580842

https://x.com/_Synthquest/status/1805291929472557333

https://x.com/devfolio/status/1802736784302030979

https://x.com/gekko_eth/status/1814856032352366636

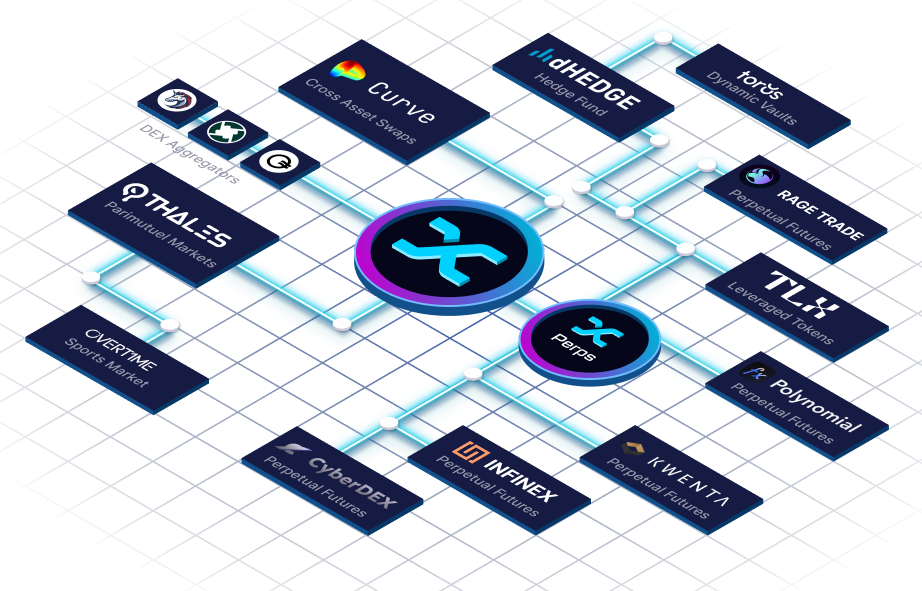

Ecosystem Update:

Kwenta | Polynomial | Rage Trade | Lyra | Thales | Pyth | TLX | Toros | Cyberdex