Spartan Research Collective #09

Highlights

✨This Month's Highlights

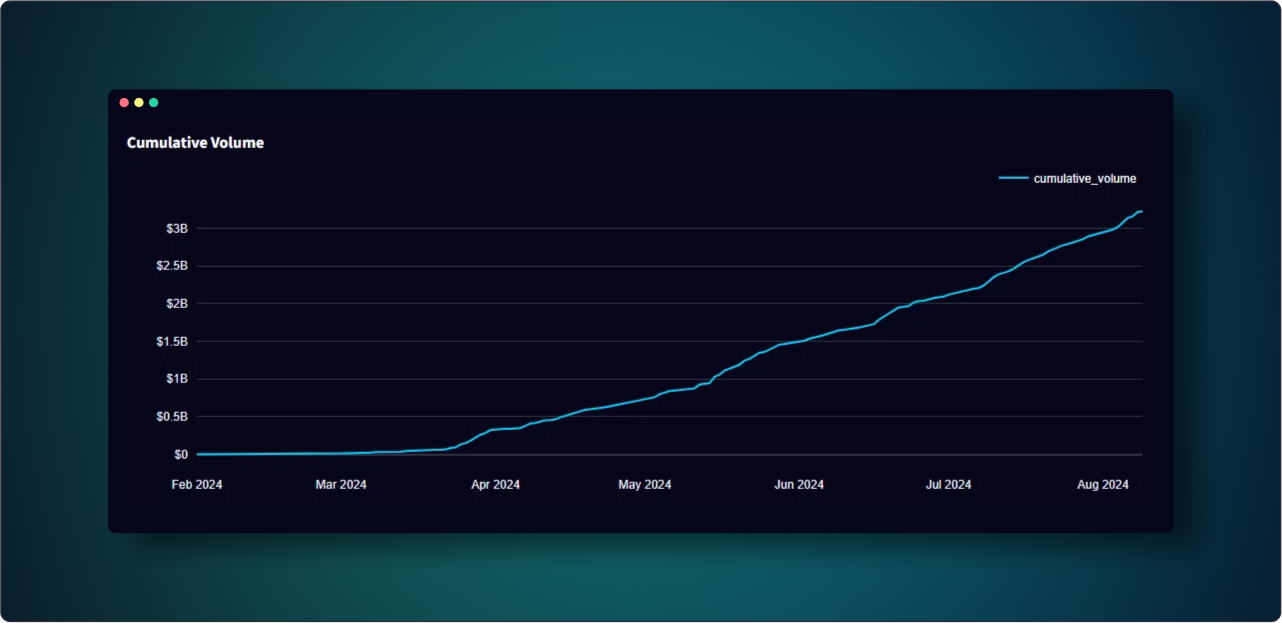

Synthetix Perps V3 Growth: Surpassed $3 billion in volume on Base, generating over $1 million in fees, with strong daily trading volumes throughout July.

Quarterly Report Highlights: V3 launched on Base and Arbitrum, with aims for $100 million daily volume; key achievements include new collateral types and automated Perps listings.

Synthetix V3 Migration: Transition to V3 on Ethereum Mainnet has begun, introducing significant changes in liquidation processes.

Boosting Institutional Activity: New initiatives are in place to attract institutional funds, focusing on trader incentives and custody solutions.

Performance Overview

Synthetix Perps V3 is seeing growth across V3 on base, recently surpassing $3 billion in cumulative volume on the Base and generating over $1 million in fees. Throughout July, trading volumes have remained robust, with most days seeing over $20 million on Base and over $30 million on Optimism. This consistent activity highlights the strong adoption and liquidity on the platform, driven by its efficient trading features and the ongoing momentum in the decentralized finance (DeFi) sector.

🐋 On-Chain Analysis - Follow The Whales

In the recent cryptocurrency market, Bitcoin (BTC) has experienced some significant volatility and has dipped to $60,000. Ethereum (ETH) has also been volatile, currently priced above $2,600. The open interest for both BTC and ETH remains strong, exceeding $6 million.

Currently, the market shows a slight skew with short open interest being higher for both Bitcoin (BTC) and Ethereum (ETH). This suggests a bearish sentiment among traders, anticipating potential price declines. However, this setup could lead to a short squeeze if prices unexpectedly rise, increasing market volatility. Monitoring related metrics and market news is crucial for making informed trading decisions.

The quarterly report is out! Check it out here Synthetix Quarterly Report Q2 2024

Check out our quick summary below 👇

V3 Scaling & Arbitrum Deployment:

V3 launched on Base and Arbitrum, aiming for $100 million daily volume and $20 million+ in LP collateral.

Arbitrum LTIP program attracted nearly $25 million in LP collateral.

Key Achievements:

Deprecation of non-sUSD spot synths (SIP-369).

Added new collateral types and markets (SIP-376, SIP-378).

Automated Perps listings framework (SIP-387).

Challenges:

Trading volume decreased to $6 billion from $10 billion in Q1.

Governance debates on Treasury Council's actions and SIP classifications.

Ambassador Council:

Secured multiple OP grants and facilitated ecosystem partner support.

Active in governance, integrator support, and marketing initiatives.

Synthetix V3 Migration: Key Updates

The Treasury Council has started the transition to Synthetix V3, as outlined in SIP 304. This phase introduces significant changes to the ecosystem, especially in liquidation processes. Staker migration to V3 on the Ethereum Mainnet (L1) is expected to open soon.

Immediate changes for L1 stakers include the introduction of immediate liquidations. Now, liquidations occur instantly at a 120% liquidation ratio, removing the previous 8-hour delay. When a staker is liquidated, their debt and SNX are transferred to V3, managed by the Treasury Council. Liquidated SNX will be distributed directly to stakers, bypassing escrow.

Ongoing Interactions Between V2X and V3:

V2X debt increases will impact the V3 legacy market.

Cross-chain synthesis between Ethereum and Optimism will remain active.

Upcoming Phase 2 Changes:

Suspension of minting, staking, and issuing sUSD on Ethereum L1.

Suspension of self-liquidation and account merging on Ethereum L1.

Implementation of an sUSD to V3 sUSD bridge.

Suspension of the debt bridge between L1 and L2.

For SNX stakers, note that while SNX can still be moved to L2, any associated debt must be repaid first. No immediate action is required from stakers. Detailed migration instructions will be provided before Phase 2, and users will have the option to migrate once a user interface (UI) is released. Users will not be force migrated, ensuring they can choose when to transition.

Boosting Institutional Fund Activity on Synthetix

Synthetix has initiated a business development (BD) working group under STP-5 to increase activity by institutional funds. Here are the key takeaways from Phase 1 of the project.

Research Phase The project began by identifying obstacles preventing professional funds from trading at scale on Synthetix. Interviews and pitches to funds and market makers led to several initiatives:

STP-10: Introduced $SNX incentives for traders exceeding $100mn/month in volume, though this target has not yet been reached.

STP-16: Engaged Wintermute to integrate with V3 and report on its strengths and weaknesses.

Custody Needs: Identified the need for integration with Fireblocks and Safe to meet institutional security standards.

Key Findings Institutional funds face a steep learning curve due to differences from traditional platforms. Onboarding documents and outreach strategies should be tailored to different fund profiles. Traders are often agnostic about which EVM-compatible chain they trade on but require specific incentive structures. A daily trading volume of $100mn is ideal for meaningful profit opportunities.

Improving the Onboarding Process A pitch deck, financial models, and an FAQ document were created to streamline onboarding. A CRM platform was also implemented to track and follow up with potential counterparties more efficiently.

Challenges and Contributions The project faced challenges such as promoting V3 before it was fully ready and obtaining clear feedback from funds. Key contributors included Troy (CC), Kaleb (CC), Burt (SC and Kwenta), Cav (CCC), and Rafa (ex-CC).

Phase 1 laid the groundwork for more effective institutional engagement, aiming to boost their activity in the Synthetix ecosystem.

Pyth Governance Distribution Phase 2 Now Live!

We are thrilled to announce that Phase 2 of the Pyth Governance Distribution is now live. Eligible Synthetix users can claim their PYTH tokens through Streamflow. To qualify, users must have held and staked PYTH tokens from the previous distribution before July 19th, 2024. Unclaimed tokens will be returned to the Synthetix Treasury Council after 28 days.

This phase strengthens participation in Pyth governance and reinforces the Synthetix-Pyth relationship.

We are also excited about an upcoming collaboration on Arbitrum, offering additional incentives for Pyth stakers using Synthetix Perps, including extra fee rebates and cross-ecosystem benefits.

Check your eligibility, claim your tokens, and engage in Pyth governance. Stay tuned for more details on the Synthetix-Pyth collaboration on Arbitrum.

Upcoming Collaboration: Synthetix and Pyth on Arbitrum

We're excited to announce an upcoming collaboration between Synthetix and Pyth designed to reward Pyth stakers and promote the cross-pollination of users on the Arbitrum network. This initiative aims to create additional value for both Synthetix and Pyth community members in addition to Arbitrum LTIP rewards.

Enhanced Rewards for Pyth Stakers

As part of this collaboration, we're planning to introduce additional incentives for Pyth stakers who engage with Synthetix Perps on Arbitrum:

Additional Fee Rebates: Pyth stakers trading on Synthetix Perps will be eligible for extra fee rebates, on top of the existing ARB LTIP fee rebates.

Cross-Ecosystem Benefits: This initiative is designed to encourage Pyth users to explore and engage with the Synthetix ecosystem on Arbitrum, fostering greater integration between our communities.

The details of this program are still being finalized. We're working diligently to create a rewards structure that provides significant value to participants while ensuring sustainability and alignment with both protocols' objectives.

🔎 Synthetix Governance:

Synthetix Improvement Proposals (SIPs) describe standards for the Synthetix platform, including core protocol specifications, client APIs, and contract standards.It is hard to play catch up with all the latest SIPs, checkout the latest ones:

SIP-383: Multi-Collateral Margin Support — Perps V3 Status: Approved

SIP-393: Launch Degenthetix on Base Status: Approved

SIP-398: Chainlink Data Streams For Synthetix V3 on Arbitrum Status: Draft

SIP-2057: Dynamic Gas Fee Module — Fjord, Status: draft

SIP-397: Transaction Costs based Rewards — Perps V3 — Fjord, Status: draft

🤝 Community Tweets:

https://x.com/kaiynne/status/1819163319238037916

https://x.com/TLX_FI/status/1818274912282517520

https://x.com/MattLosquadro/status/1817959334019743758

https://x.com/MacroMate8/status/1814313392619810946

https://x.com/mastermojo83/status/1815736341562376275

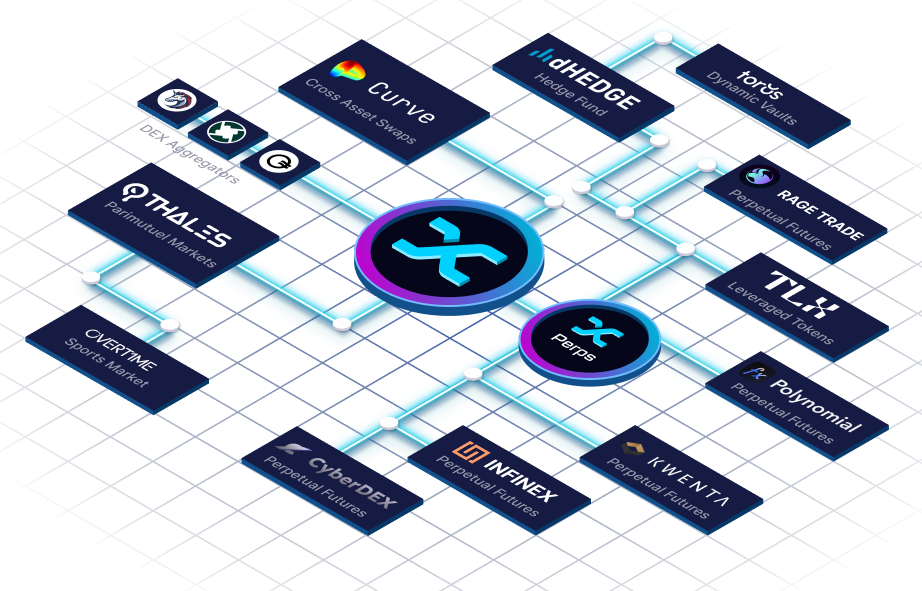

Ecosystem Update:

Infinex | Kwenta | Lyra | Thales | Pyth | CyberDex | Overtime | TLX | Toros